*Editor’s Note: The “Views from NAU” blog series highlights the thoughts of different people affiliated with NAU, including faculty members sharing opinions or research in their areas of expertise. The views expressed reflect the authors’ own personal perspectives.

By Landi Morris

By Landi Morris

Assistant professor of accounting, The W. A. Franke College of Business

Did you know that in 2023, Arizona waved goodbye to its progressive tax rate structure and adopted a flat tax rate of 2.5 percent? So, what does that mean for you and your 2024 tax filing? Look no further! Landi Morris, assistant professor of accounting in The W. A. Franke College of Business, broke it down for The NAU Review.

What is a flat tax?

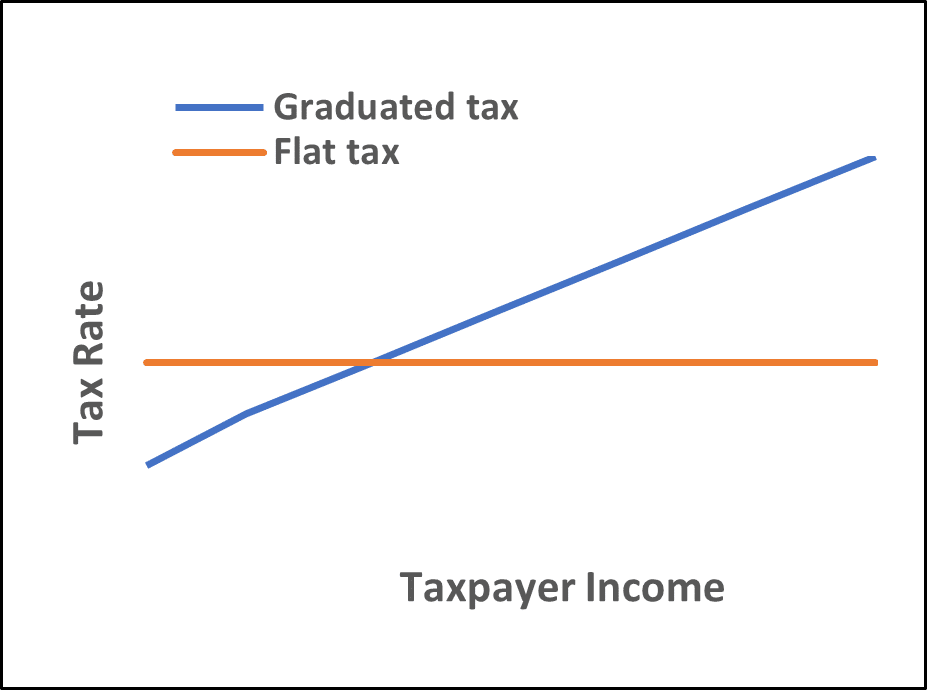

Tax rate structures can be characterized in one of two ways—flat or graduated. A flat tax applies the same tax rate to all taxpayers, regardless of the taxpayer’s income. Under a graduated structure, the tax rate varies based on the taxpayer’s income—the more money you earn, the higher rate of taxes you pay.

Why a flat tax?

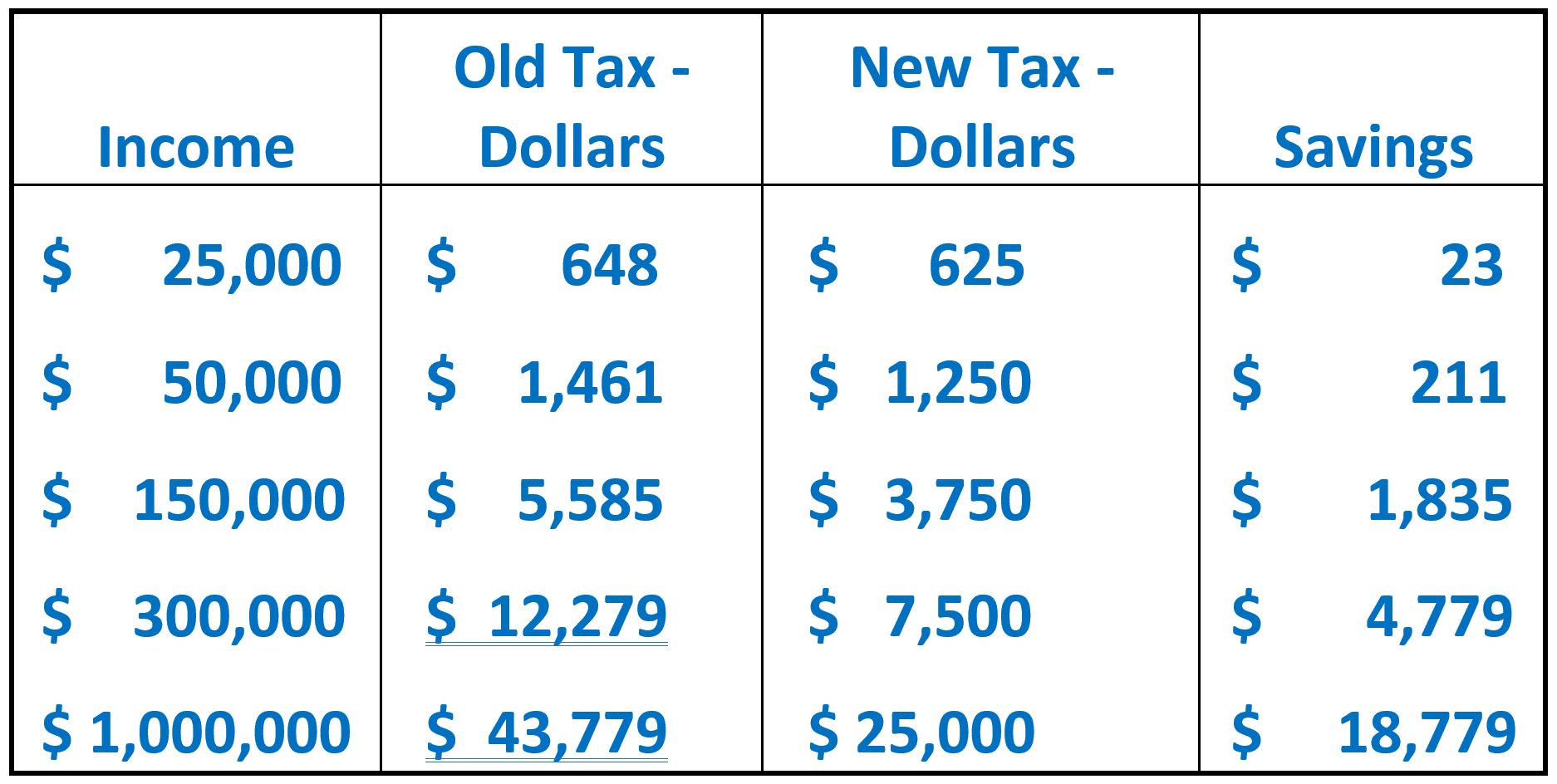

Potential benefits of a flat tax include greater efficiency, as it eases compliance for both taxpayers and the state. Proponents of a flat tax also tout that the tax saves taxpayers’ money. Opponents of a flat tax argue that it violates the concept of vertical equity (where taxpayers with more income should pay a higher tax).

Vertical equity: Taxpayers with more income should pay a higher tax

What does this mean for you? Changes to the 2023 tax rate structure mean changes to state withholdings from your paychecks. The new default withholding rate for AZ is 2 percent, so now is the time to review if this amount is appropriate for you. If you want to change this percentage, you can do so at any time during the year. Talk to your employer about how to make that happen.