In light of the recently announced tariffs on steel and aluminum imports, Informatics professors at Northern Arizona University mapped out how far-reaching the effects of those trade tariffs could be for U.S. communities and industries.

Benjamin Ruddell, an associate professor in the School of Informatics, Computing and Cyber Systems (SICCS), leads the National Science Foundation-funded FEWSION Project (ACI-1639529), which maps the U.S. economy’s food, energy and water systems and their connections to the broader economy and environment. He and other professors mapped the possible effects of these proposed tariffs, which has raised the specter of a trade war.

“While the goal of the tariffs is to protect selected U.S. communities and industries who sell at a disadvantage versus their foreign competitors, retaliatory tariffs by our trading partners can hurt other U.S. communities and industries,” Ruddell said. “Therefore, tariffs can increase the cost of doing business for the U.S. economy because businesses must pay higher prices for their steel, aluminum and other inputs. The U.S. is a major exporter of tourism, aircraft, vehicles, heavy equipment, medical products, agricultural products and high-tech goods and services, among other goods and services.”

FEWSION scientists have mapped the largest international trading partners for each county in the United States, along with the goods and services that comprise most of this trade. U.S. tariffs that hit large imports will raise the cost of doing business in these counties, while foreign retaliation that hits large exports will directly damage local sales, gross domestic product and jobs. U.S. steel tariffs protect coal and steel jobs in the rust belt, but if Asian steel producers like China retaliate by placing tariffs on U.S. agricultural products, it hurts the farm belt.

“Uncertainty with global trading partners has real, local implications,” said Richard Rushforth, assistant research professor in SICCS. “For example, the tariffs proposed by China to counter U.S. tariffs have already had nearly a quarter-billion-dollar impact on Iowa livestock producers. Tariffs shouldn’t be viewed as something happening to someone else, but rather as policies that will impact your wallet.”

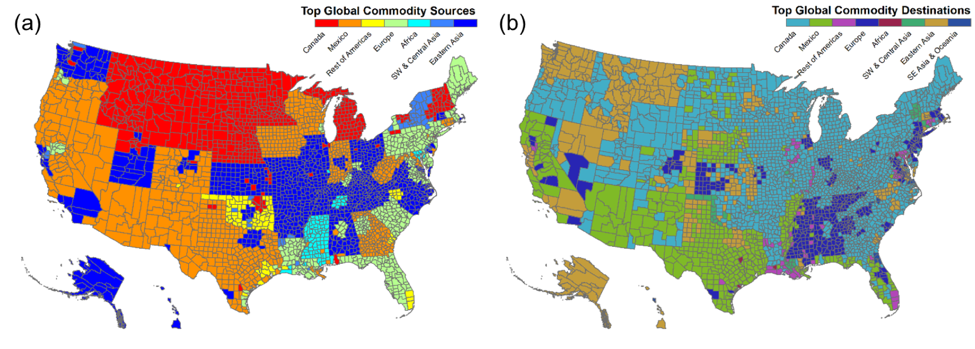

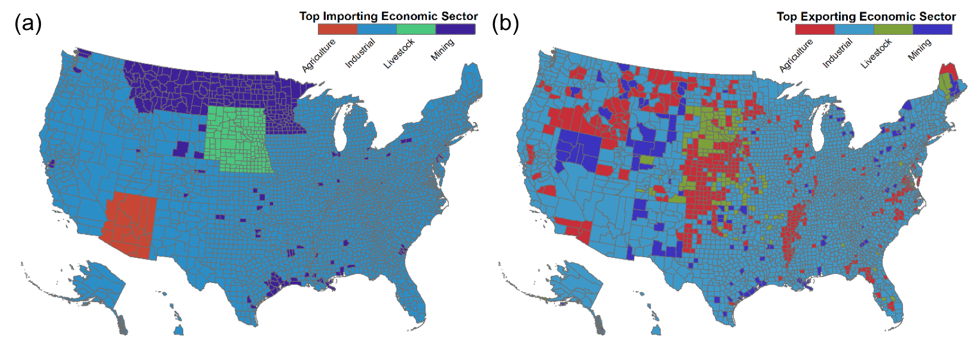

While most of the United States imports industrial and manufactured products, Arizona imports more agricultural products, and these goods are mostly from Mexico. Canada and Mexico, which may be exempted from the new tariffs, are the top trading partners for much of the nation. However, FEWSION analysis shows that the central Midwest, urban West Coast and the East Coast import primarily industrial and manufactured goods from Asia and Europe, where new tariffs may impose costs on local communities. The Northern Rockies, Western Plains, Mississippi Corridor, urban West Coast and urban East Coast export a lot of agricultural, industrial and manufactured goods to China and the European Union, which now are openly discussing retaliatory tariffs.

Metropolitan areas and ports in the eastern half of the United States, Texas and California; agricultural areas in the Midwest (Texas, Kansas, Nebraska, Iowa, Missouri, Arkansas, Minnesota); industrial, agricultural and mining areas in Oregon, Washington, Montana, Idaho and northern Nevada; Alaska; and Hawaii are especially vulnerable to tariffs on East Asian trading partners.

There are winners and losers in a trade war. How will your community fare? For more information and additional maps, go to FEWSION’s website.

Figure 1: The U.S. has a large, diversified and regional economy. Top global commodity trading partners have local and regional patterns. Canada tends to be the largest global trading partners along the Canadian border as well as Mexico along the Mexican border. However, some areas tend to have strong local-to-global connections, such as upstate New York, Oklahoma and Mississippi.

Figure 2: The U.S. has a large, diversified and regional economy with respect to goods most traded on the global market. States along the Canadian border tend to have large dependence on oil and gas (mining) from Canada. Arizona is a large import source of Mexican agriculture.

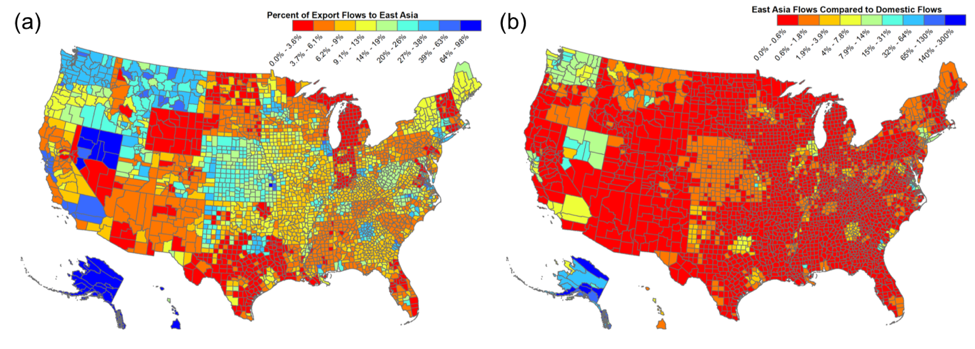

Figure 3: (a) The market value of export commodity flows to East Asia compared to the market value of to all world regions for 2012. (b) The market value of export commodity flows to East Asia compared to the market value of domestic commodity flows for 2012. Both maps show that metropolitan areas and ports in the eastern half of the U.S. and Texas; agricultural areas in the Midwest (Texas Panhandle, Kansas, Nebraska, Minnesota); the Pacific Northwest, including Montana and Idaho in addition to northern Nevada; the Los Angeles and San Francisco metropolitan areas; Alaska; and Hawaii are especially vulnerable to tariffs on East Asian countries.